what is suta tax rate

Were updating this information to account for recent legislative changes. Voluntary contributions must be made within 30 days following the date that the Unemployment Tax Rate Assignment Form was mailed.

What Is The Futa Tax 2022 Tax Rates And Info Onpay

0540 54 or 378 per employee.

. Louisiana Unemployment Insurance Tax Rates. Taxable employers in the highest rate class pay 57 percent not counting delinquency or Employment Administration Fund taxes. The contribution rate.

SUTA rates in each state typically range from 065 to 068. What is the Arizona State unemployment tax rate for 2021. The 2022 wage base is 7700.

The tax rate shown on the Unemployment Tax Rate Assignment Form becomes final unless protested in writing prior to May 1 of the following year. Employers who are delinquent in paying their taxes may have to pay an additional 2 percent delinquency tax. SUTA dumping involves the manipulation of an employers UI tax rate andor payroll reporting to owe less in UI taxes.

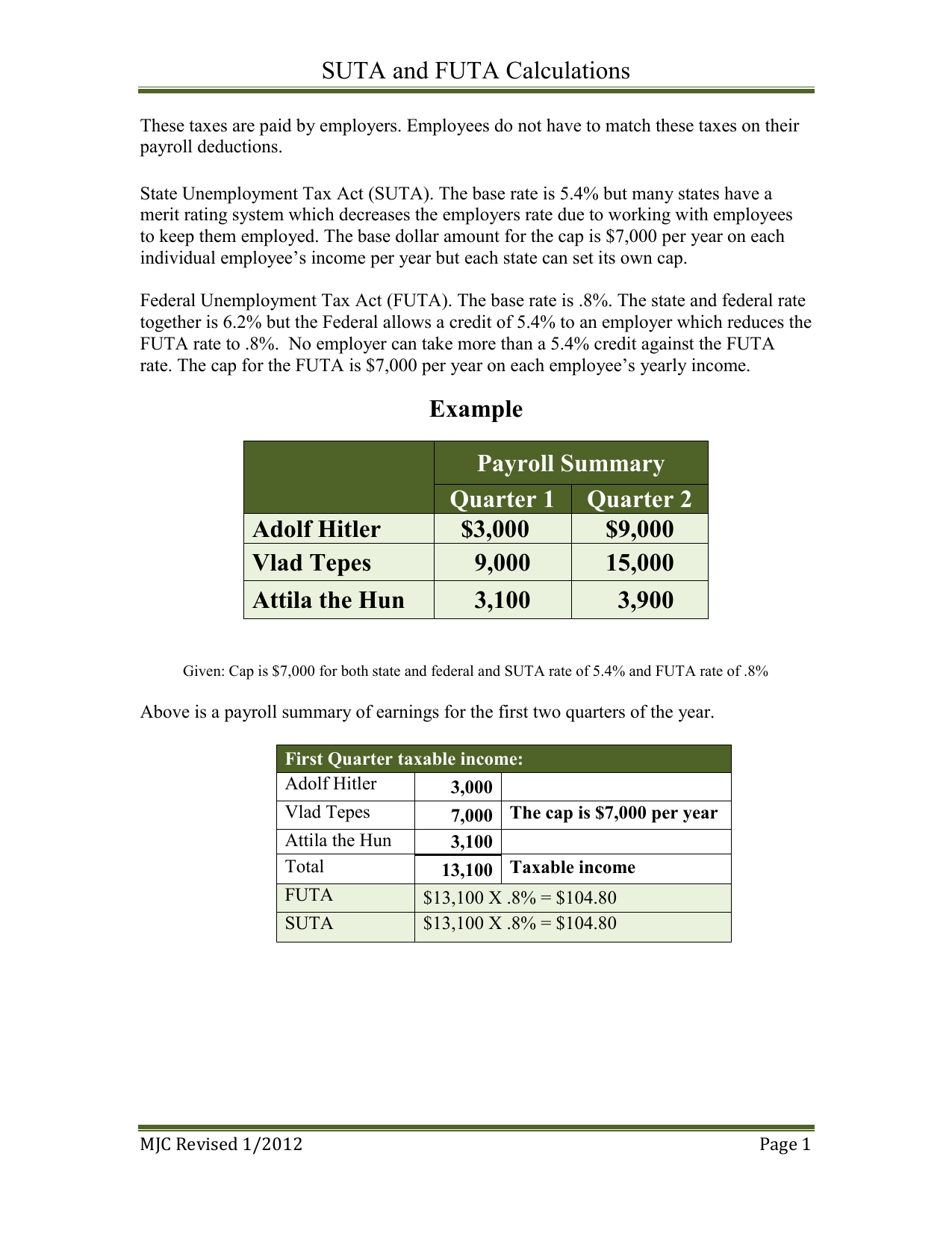

Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever. The federal government applies a standard 6. If you are subject to FUTA tax you must pay the current rate for up to the first 7000 in wages for each employee.

009 00009 for 2nd quarter. The best negative-rate class was assigned a rate of 1245 percent which when multiplied by the 46500 wage base results in a tax of 57892 while those in the worst rate class pay at the rate of 5400 percent or 2511 when multiplied by 46500. 24 new employer rate Special payroll tax offset.

0010 10 or 700 per employee. Taxable base tax rate. 52 rows An employers SUTA rate is often referred to as a contribution rate.

Employers may make a voluntary contribution to reduce the tax rate. For example if you own a non-construction business in California in 2021 the SUTA new employer tax rate is 34 and the taxable wage base per worker is 7000. How is the SUTA rate calculated.

State Unemployment Tax Act SUTA avoidance or dumping is a form of tax avoidance or UI tax rate manipulation through which employers dump higher UI taxes by attempting to obtain a lower rate. SUTA Tax Rates. This means that the employer has not paid the tax due on the payroll on or before.

Arizonas unemployment-taxable wage base is. You can view your tax rate by logging in to the Departments Reemployment Tax file and pay website. 4 rows FUTA is federally managed and states regulate SUTA.

The employer Premium Rate Chart is then used. This means the effective federal tax rate is 06 percent. Employers with a zero rate are still required to file quarterly contribution and wage reports.

This percentage is applied to taxable wages paid to determine the amount of employer contributions due. You can decrease this federal rate by up to 54 percent of the rate you pay to your state sometimes referred to as SUTA tax or the State Unemployment Tax Act. SUTA rates by state as well as the taxable wage base differ from each other.

This contribution rate notice serves to notify employers of their. Tax rates for 2021 range from 008 to 206. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee.

Employer UI tax rate notices are available online for the following rate years. The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years. If an employer has no paid taxable payroll during the four-year period ending June 30th of the prior year they are assigned the maximum base tax rate of 62.

The 2018 rate is 6 percent. The reserve ratio is calculated annually as a measure of the employers potential liability for benefits. New Employer Rate If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the the 2019 rate is 59 the 2020 rate is 58 the 2021 rate is 58 and the 2022 rate is 55.

009 00009 for 1st quarter. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. Specific industries with higher rates of turnovers might experience an increase in SUTA tax rates.

A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year. The tax rate for new employers is to be 2 for 2022 unchanged from 2021. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year.

Multiply the tax rate by the taxable. When the United States Department of Labor certifies that the states unemployment compensation program meets federal requirements employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their FUTA tax rate. 2022 PDF 2021 PDF 2020 PDF.

The tax rates vary from state to state and are updated periodically.

Are Employers Responsible For Paying Unemployment Taxes

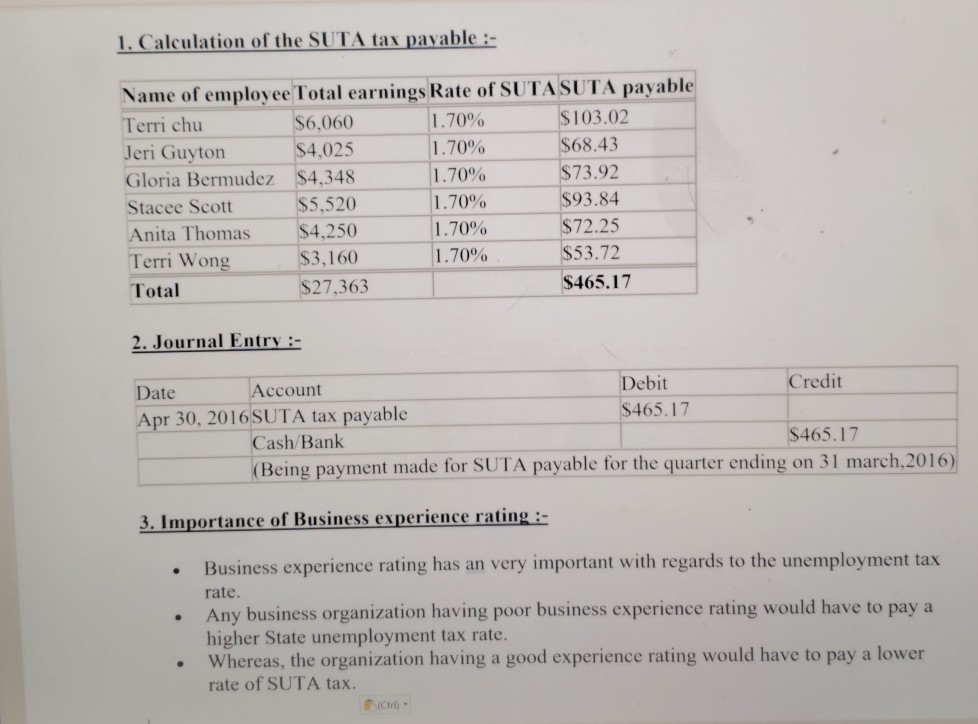

Solved 1 Calculation Of The Suta Tax Payable Name Of Chegg Com

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

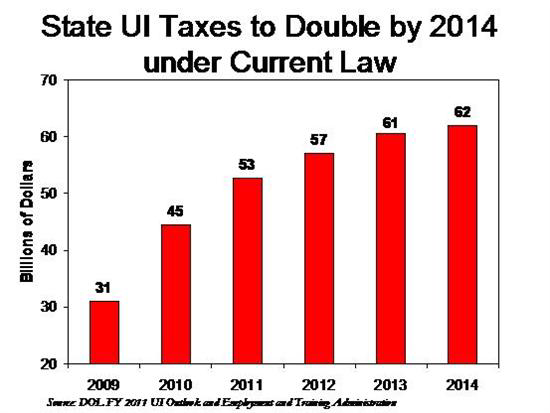

How To Reduce Your Clients Suta Tax Rate In 2014

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

How To Calculate Unemployment Tax Futa Dummies

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Futa Suta Unemployment Tax Rates Procare Support

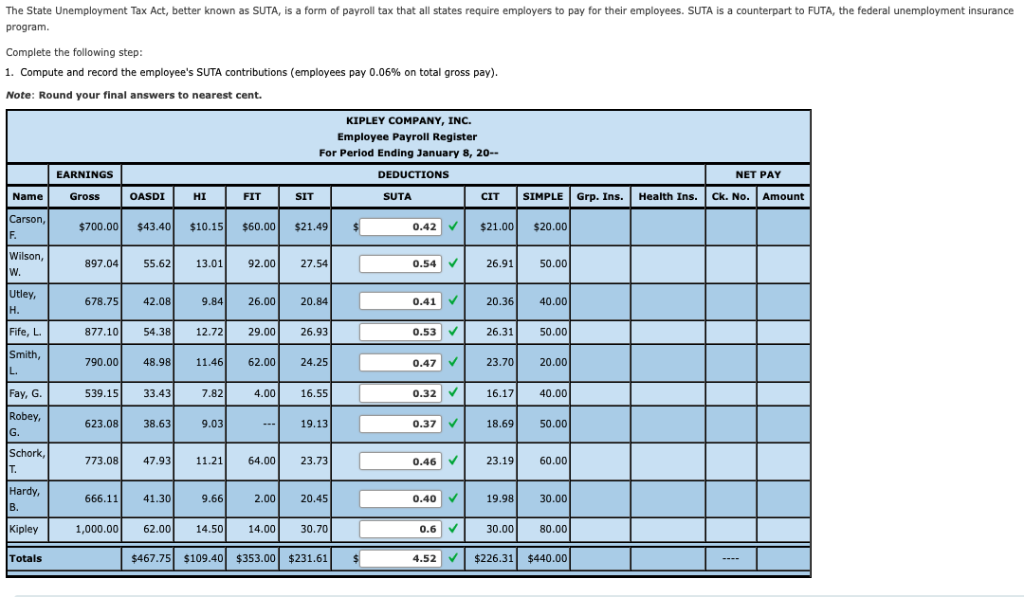

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

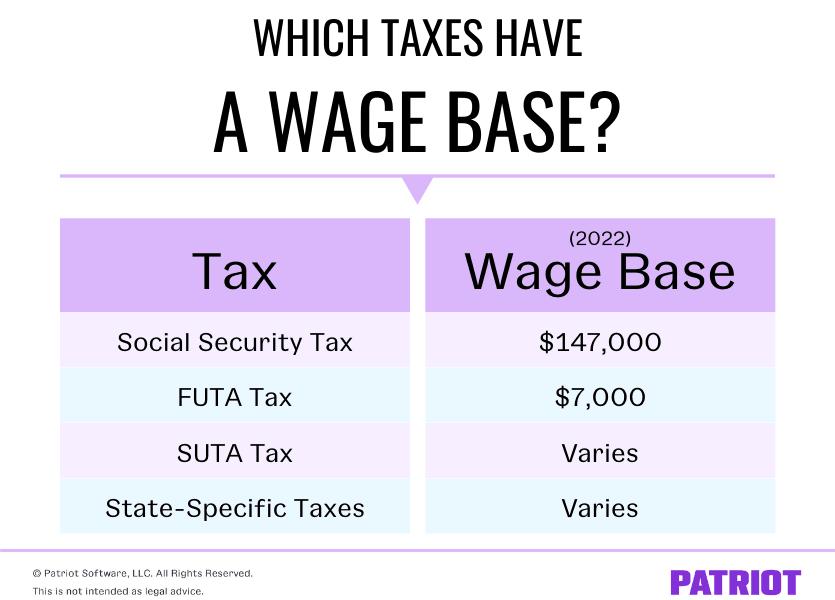

What Is A Wage Base Definition Taxes With Wage Bases More

Systems Understanding Aid 9th Edition Suta And Futa Calculations

2022 Federal State Payroll Tax Rates For Employers